Product Forecasting: Understanding Demand Throughout the Product Life Cycle

Demand forecasting is tough.

Demand forecasting over the entire product life cycle during the course of launch, maturation, and end-of-life is tougher still.

This is true for any business with sizable turnover in the product portfolio, but product forecasting in industries like retail, electronics, and aftermarket parts is especially challenging.

First, let’s define our terms so we can understand the complete picture of product forecasting and how it relates to the product life cycle.

What is Product Forecasting and Why is it Important?

Product forecasting is the process of predicting the future demand for a product by accounting for variables like historical data, weather, seasonality, and consumer preferences.

Product forecasting–particularly new product forecasting–is vital for avoiding the pitfalls of unbalanced inventory.

Without a clear understanding of demand, you may end up with too much inventory cluttering up your warehouses, leading to added costs and reduced margins should you need to reduce prices.

Alternatively, too little inventory leaves you unable to meet customer demand, leading to reduced customer satisfaction, decreased loyalty, and missed revenue opportunities.

Leveraging AI and machine learning can provide the accurate demand forecast needed throughout the product life cycle to ensure an optimal customer experience, maximize working capital, and build market share.

If you understand the demand behavior for a product, you can predict how much of that item to manufacture or order, as well as where and when to distribute it most effectively.

What is the Product Life Cycle?

The product life cycle covers the span of time from the introduction of a new product to its removal from the circulated product portfolio.

Once product development is completed, there are typically four product life cycle stages.

- Introduction Stage: The marketing team gets the ball rolling by educating consumers about the new product, promoting it, and creating buzz.

- Growth Stage: The product has gained moment and demand is taking off. Production ramps up and the product may be distibuted to more locations and regions to capitalize on growing interest.

- Maturity Stage: The product enjoys popularity while the company enjoys profits from increased sales and reduced marketing and production costs.

- Decline Stage: The popularity of the product diminshes, whether due to increased competition, the passing of a fad or trend, or other market variables.

Each of these stages holds its own product forecasting challenges for planners trying to get ready for consumer responses.

The Challenges of Product Forecasting Throughout the Life Cycle

New product forecasting is difficult because you don’t have historical sales data and you don’t have a good idea of how quickly the product will take off.

Moreover, the product launch itself may skew initial perceptions of demand, reducing forecast accuracy and complicating inventory management.

Plus, early sales data can be notoriously deceptive due to channel packing.

Shipping a bunch of new products to distribution centers or stores to fill bins and shelves can create an initial surge that is not necessarily a good indicator of sustainable end-user demand.

Substitution and replacement part demand can be somewhat easier to predict.

But even they can be tricky if channel packing creates unexpected demand spikes or if it is hard to determine which previous histories are most applicable to how demand for the new product or part will affect future sales.

End-of-life planning and campaign planning require balancing the need to satisfy demand while avoiding markdowns or reducing obsolescence.

The goal is to deliver high in-season customer service levels, with a graceful end-of-life or end-of-season exit.

The Two Forecasting Mistakes that Obscure Product Demand

Chances are, there are two reason your current forecasting method isn’t giving you a clear picture of demand.

1. Many firms manage demand variability with manually intensive processes.

Manual sales forecasting methods allow more than enough opportunity for human error and miscalculations.

They don’t provide the automation and speed required to process massive amounts of data accurately and efficiently.

Often, they end up increasing the planner workload and reducing productivity, instead of giving planners more time for value-added activities.

2. Firms often take a different approach for each life cycle phase, with distinct algorithms for each one.

In this scenario, planners have to figure out at what point to switch from one phase to another. They make this decision according to the plan, not actual demand.

This jolts the supply chain, sending a signal through the chain that is not based on anything that happened to product demand, but rather on the planning algorithm.

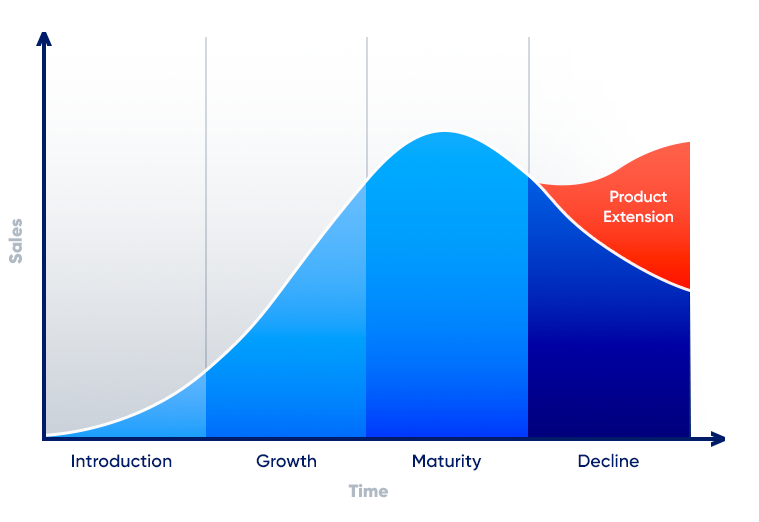

The reality is that the product life cycle is fluid; a product doesn’t suddenly “decide” that it is now in one phase or the other.

Image source: Stanislav Kondratiev

Products typically transition smoothly, and the system must also smoothly transition with that demand pattern, as it reveals itself.

The Keys to Effective Product Forecasting at Each Product Life Cycle Stage

The right tools and strategy make all the difference when it comes to demand forecasting.

Supply Chain Planning Software

Demand sensing software—and the subtle or larger changes in the demand pattern—can suggest whether the product is in or transitioning to maturation or an end-of-life demand profile.

A demand modeling solution should monitor and sense demand automatically, and alert the user on an exception-only basis if something is out of the ordinary.

With the proper understanding of retail demand planning, you can position merchandise effectively and manage pricing and promotions to shape consumer buying behaviors.

It then becomes a more hands-off view—as well as a calmer, quieter, more smoothly operating supply chain, in service of the entire product life cycle.

Downstream Visibility

Often the answer lies downstream—the further downstream you go, the purer the demand signal.

Whether product introductions, midcourse sales, or end-of-life downslope, if you can get closer to the point of sale, you have an early signal of demand at each life cycle phase.

Data, Machine Learning, and Automation

New data sources and machine learning automation are also making improvements to forecasting the product life cycle.

For instance, social media can both fuel and demonstrate demand.

- If the new product is on your website, you can track indicators such as the number of clicks or page views, or how much time they spend on detailed product descriptions.

- If you’re announcing a replacement upgrade on Twitter, you can see how many tweets or retweets you get.

- If you publish product news on Facebook or Instagram, you can count shares and likes as early indicators of an end-of-life slowdown.

This massive amount of data requires the right tools to manage it, which is where an effective automated or machine-learning-based solution comes in.

This technology effectively tracks and predicts demand, generating better forecasts and improving inventory management.

Forecasting over the entire product life cycle is still a challenge–but new methods, data and machine learning for supply chain forecasting are creating opportunities to make it more manageable.

Final Takeaways for a Strategic Product Forecasting Method

Let’s sum up here.

There are two main challenges in effectively forecasting customer demand, from new product introduction to end-of-life:

- There is no sales history and early sale data can be deceptive.

- You need enough inventory to satisfy customer demand when the product has hit the height of its maturity, but you want to avoid obsolescence during the end-of-life phase.

These 4 tips can help you refine your forecasting model, boost profit, and smoothly transition from one phase of the life cycle to the next:

- Don’t lean on manual processes where an arbitrary flip switches from one algorithm to the next without accounting for the available data and consumer behavior.

- Invest in tools that can handle large amount of information automatically and can create a clearer picture of demand.

- Keep an eye on downstream operations for the purest demand signal.

- Use machine learning and automation to understand data, track consumer engagements, and spot the trends that signal the next product life cycle stage.